Hashdex’s Groundbreaking Move: Nasdaq ETFs for Bitcoin and Ethereum on the Horizon

Hashdex, the trailblazing asset management company, is set to revolutionize the cryptocurrency investment landscape with its latest filing. Nasdaq, seeking SEC approval, aims to list Hashdex’s Nasdaq Ethereum ETF, pioneering a unique approach that combines spot ether holdings and futures contracts. This dynamic strategy aligns with the regulatory framework, offering investors a novel avenue for cryptocurrency exposure.

The surge in cryptocurrency ETF applications, including spot bitcoin and ether ETFs, marks a transformative period. The SEC, having previously rejected spot bitcoin ETFs, faces evolving dynamics post a legal battle setback in August. Hashdex’s filing, distinct in approach, awaits SEC decision, presenting an alternative route to market price tracking without the Coinbase surveillance sharing agreement.

Hashdex’s pursuit of a spot Bitcoin ETF introduces a notable departure from recent filings. Embracing a strategy independent of the Coinbase surveillance sharing agreement, Hashdex opts to acquire spot Bitcoin from physical exchanges within the CME market. While the SEC defers its decision on Hashdex’s application, the unique approach adds an intriguing layer to the evolving narrative of crypto ETFs in the U.S.

Brazil emerges as a significant player in the demand for spot bitcoin ETFs, with vehicles trading successfully for over two years. Hashdex’s spot Bitcoin ETF, operational since August 1, 2021, boasts $57.8 million in assets under management (AUM) as of November 21, 2023. Brazil’s success is attributed to pro-market digital assets regulation and heightened institutional interest, offering insights into potential future trends in global cryptocurrency adoption.

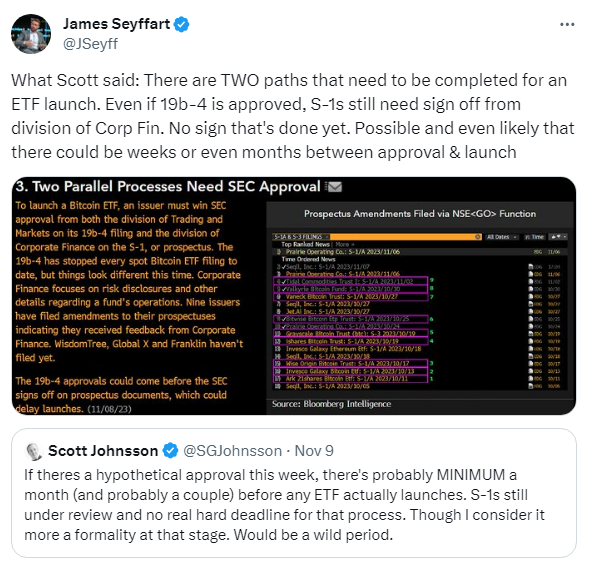

Anticipation surrounds the potential SEC approval of a spot Bitcoin ETF, deemed a game-changer for crypto investors. Presently, U.S. investors navigate Bitcoin futures ETFs, indirectly engaging with the digital asset. The long-awaited approval of a Bitcoin spot ETF promises direct investment in the digital asset, providing a more accessible avenue for investors.

Insiders suggest the SEC’s first approval could materialize in early 2024, a development that holds significant weight for the crypto market. A Nasdaq survey reveals over 72% of financial advisors expressing increased interest in crypto investments with the approval of spot ETFs. As the regulatory landscape evolves, Hashdex’s Nasdaq Ethereum ETF and other anticipated spot Bitcoin and Ether ETFs are poised to trade by Q2, signaling a transformative phase in crypto investment.

Explore the intricate details of Hashdex’s groundbreaking move and the evolving landscape of cryptocurrency investment on Search Engine Loud. Stay informed on the latest developments shaping the future of crypto investments.