Bitcoin’s Price Stability Faces Critical Test Amidst Volatility

The cryptocurrency market is buzzing with anticipation as Bitcoin, the flagship digital asset, clings to a price point above $43,000. While the crypto community rejoices in its resilience, analysts are sounding cautionary notes about the possibility of a looming pullback to levels below $40,000.

A Delicate Balancing Act

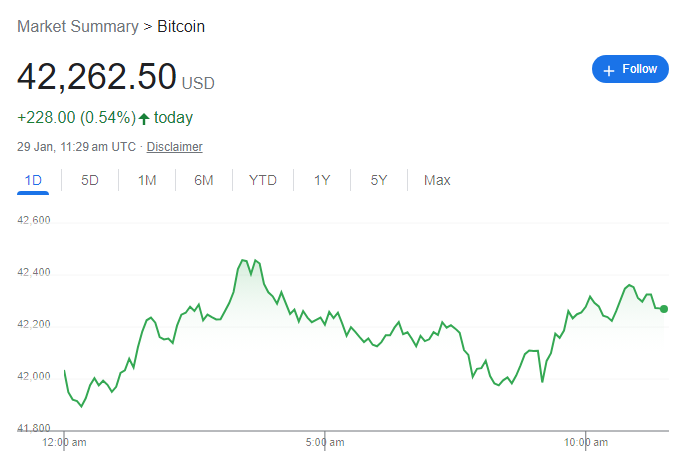

Bitcoin’s price has been dancing to its unique rhythm, with analysts and traders closely observing its every move. A recurring theme in discussions revolves around the urgent need for an upward recovery. This sentiment has been compounded by the consistent rejection of the price above the $43,500 mark.

Adding to the complexity, long position holders have been forced to liquidate as the price encounters resistance, contributing to the ongoing market volatility. These dynamics have put Bitcoin at a crucial crossroads, where the potential for both upward momentum and a price correction looms large.

Transaction Fees Surge Amidst Mempool Backlog

In an unforeseen turn of events, Bitcoin’s transaction fees have surged to a staggering $40, reigniting debates and discussions about scalability and efficiency. A growing mempool backlog has prompted a renewed push for Layer 2 (L2) solutions that can alleviate congestion and ensure smoother transactions on the network.

Despite these challenges, Bitcoin’s rally shows no signs of slowing down, with year-to-date gains reaching an impressive 161%. The cryptocurrency’s resilience and attractiveness as an investment continue to capture the attention of both institutional and retail investors.

Eyes on the $38,000 Level and Retail Investor Engagement

As the cryptocurrency’s journey unfolds, analysts are closely monitoring the $38,000 level as a potential bottom in the event of a pullback. This critical threshold serves as a litmus test for Bitcoin’s ability to weather short-term market turbulence.

Simultaneously, discussions about the involvement of retail investors in the cryptocurrency market are gaining traction. Their participation is viewed as a key driver in shaping Bitcoin’s future trajectory, highlighting the ever-expanding appeal of digital assets beyond institutional boundaries.

Stay tuned to Search Engine Loud for comprehensive coverage and insights into Bitcoin’s evolving landscape as it navigates the intricacies of price fluctuations and market dynamics.