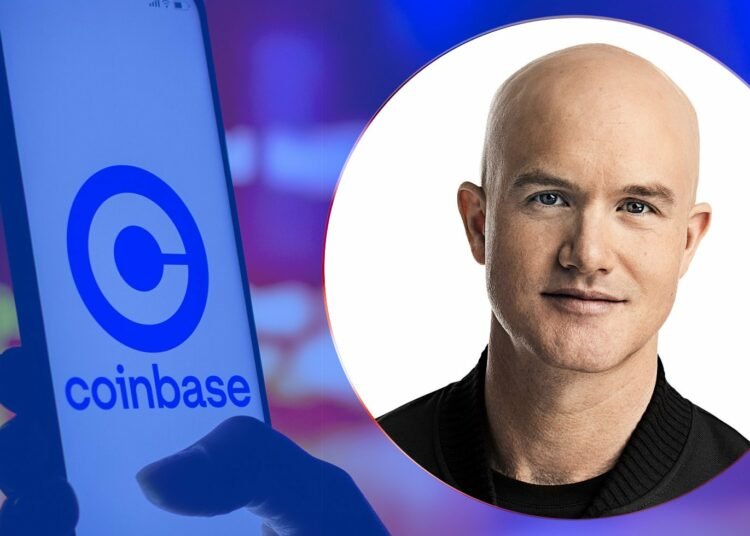

Coinbase CEO Brian Armstrong Bullish on Crypto’s Future Post-Binance Settlement

Coinbase CEO Brian Armstrong‘s recent remarks following the settlement between Binance and the U.S. Department of Justice have sent ripples through the cryptocurrency industry. Armstrong’s optimism about the industry’s future is grounded in the belief that the resolution will usher in a new era, free from the shadows of “bad actors” and characterized by increased regulatory clarity. According to Armstrong, this clarity will not only attract more investment but is poised to be a magnet for institutional players eyeing the crypto space.

In a recent interview, Armstrong stressed the pivotal role of regulatory compliance, underlying Coinbase’s unwavering commitment to adhering to U.S. regulations. Despite the company’s expansion efforts into other jurisdictions, Armstrong underscored the significance of maintaining a strong presence in the U.S. market. Additionally, he expressed his belief in the potential impact of launching a spot-bitcoin ETF, anticipating that it could usher in new sources of capital and further legitimize the cryptocurrency industry.

Armstrong’s statements come against the backdrop of the U.S. government’s substantial $4 billion enforcement action against Binance. The regulatory measures resulted in Binance’s founder and CEO, Changpeng Zhao, stepping down and pleading guilty to charges of money laundering violations. Armstrong views this enforcement action as a catalyst for the crypto industry to turn a new leaf, leaving behind a trail of scandals and problems. He maintains that this could pave the way for a more regulated and legitimate future for the industry.

Armstrong directly addressed common criticisms of the cryptocurrency space, dismissing claims that crypto is predominantly used for illicit activities. He cited statistics suggesting that illicit activity in crypto represents less than 1%, a figure significantly lower than the illicit uses of cash. According to Armstrong, these arguments fail to acknowledge that traditional currencies often see a higher percentage of illicit transactions compared to their digital counterparts.

The sentiments expressed by Armstrong align with a broader industry perspective, viewing the Binance settlement as a pivotal moment. Many believe that overcoming past scandals and demonstrating a commitment to regulatory compliance will be crucial in attracting more institutional investment and shaping the industry’s trajectory in the coming years.

As the crypto community eagerly awaits further details on the Coinbase-Binance settlement, the prevailing sentiment is one of cautious optimism. This development has the potential to reshape the narrative around cryptocurrency, showcasing a commitment to transparency, regulatory compliance, and the long-term sustainability of the digital asset space.

In the realm of best cryptocurrency news and Search Engine Loud, this positive shift post-Binance settlement stands out as a notable milestone, emphasizing the industry’s commitment to responsible practices and growth. For the latest and trending news, be sure to reach out to Search Engine Loud.