Unveiling the World of Bitcoin Mining: How does bitcoin mining work ?

In the world of cryptocurrencies, Bitcoin stands as the pioneer and the most widely recognized digital asset. But have you ever wondered how new Bitcoins come into existence? The answer lies in the fascinating process of Bitcoin mining. In this comprehensive guide, we’ll explore what Bitcoin mining is, the types of mining, essential tools, key players, and the regulations that govern this intricate ecosystem.

What is Bitcoin Mining?

Bitcoin mining is the process by which new Bitcoins are created and transactions on the Bitcoin network are validated and added to the public ledger called the blockchain. It’s not done by individuals with shovels, but rather by powerful computers solving complex mathematical problems.

Types of Bitcoin Mining

Bitcoin mining comes in various forms, each with its unique characteristics:

- Solo Mining: Individuals or small groups of miners use their own hardware to mine Bitcoins. While this offers full control, it’s highly competitive and may not be profitable for all.

- Pool Mining: Miners combine their computational power and rewards, distributing Bitcoins equally based on the contributed work. Pool mining provides a steady income stream for participants.

- Cloud Mining: This involves renting mining power from a remote data center. It’s user-friendly but may involve certain risks, including fraud.

- ASIC Mining: Application-Specific Integrated Circuit (ASIC) miners are specialized hardware designed solely for Bitcoin mining. They offer unparalleled processing power but can be costly.

Tools for Bitcoin Mining

- Mining Hardware: To mine Bitcoin effectively, you need specialized mining hardware. ASIC miners, such as those from Bitmain, Canaan, and MicroBT, dominate the industry due to their high hashing power and energy efficiency.

- Bitcoin Mining Software: Mining software connects your hardware to the Bitcoin network. Popular options include CGMiner, BFGMiner, and EasyMiner. Each software has its own features and compatibility, so choose wisely.

- Bitcoin Wallet: You’ll need a secure Bitcoin wallet to receive your mining rewards. Software wallets, hardware wallets, and online wallets are available, each with varying levels of security.

How Does Bitcoin Mining Work?

Bitcoin mining is essentially a competition among miners to solve a complex mathematical puzzle. Miners use their hardware to process transactions, and the first one to solve the puzzle gets the privilege of adding a new block of transactions to the blockchain. This process is known as proof-of-work (PoW) and is crucial for securing the network.

How Long Does It Take to Mine Bitcoin?

The time it takes to mine one Bitcoin can vary significantly based on several factors, including the mining hardware’s processing power, the current network difficulty, and the mining pool’s collective hash rate. On average, with powerful ASIC miners, it takes approximately 10 minutes to mine a single Bitcoin block.

Is Bitcoin Mining Profitable?

The profitability of Bitcoin mining depends on several factors, including electricity costs, hardware expenses, Bitcoin’s market price, and the mining difficulty. It’s essential to use a Bitcoin mining calculator to estimate potential profits accurately.

Key Players in Bitcoin Mining

Bitcoin mining has evolved from a hobbyist endeavor to an industry dominated by major players. Here are some of the significant contributors:

- Bitmain: Bitmain is a Chinese mining hardware manufacturer and one of the largest players in the industry. They produce the popular Antminer series of ASIC miners.

- F2Pool: F2Pool, also known as DiscusFish, is one of the largest Bitcoin mining pools globally. It offers a platform for miners to combine their computational power and share rewards.

- Slush Pool: Slush Pool, created by the legendary Bitcoin advocate Slush, is the world’s first Bitcoin mining pool. It has a reputation for stability and transparency.

Rules and Regulations

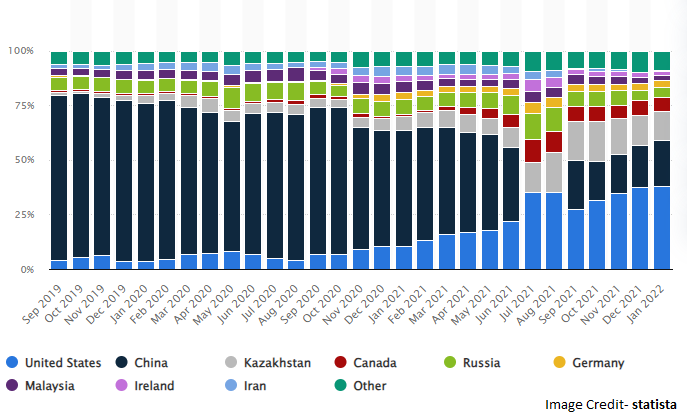

Bitcoin mining operates within a complex regulatory landscape that varies from one country to another. Here are some key regulatory considerations:

- Electricity Costs: Electricity expenses significantly impact profitability. Some countries offer lower electricity rates, making them attractive for miners.

- Environmental Impact: Bitcoin mining’s energy consumption has raised concerns about its environmental impact. Some regions have stricter regulations related to energy usage.

- Taxation: Miners may be subject to taxation on their mining rewards. Regulations vary widely, so it’s essential to understand your country’s tax laws.

- Licensing and Compliance: Certain regions require miners to obtain licenses or comply with specific regulations. Failure to do so can result in legal issues.

In Conclusion

Bitcoin mining is a dynamic and essential component of the cryptocurrency ecosystem. It involves various types, requires specialized tools, and operates within a framework of rules and regulations that continue to evolve. As the crypto world advances, understanding Bitcoin mining becomes increasingly vital for both enthusiasts and potential miners.

If you’re interested in Bitcoin mining, remember to conduct thorough research, stay updated on the latest developments, and consider factors like hardware costs, electricity expenses, and regulatory compliance. With the right knowledge and resources, you can embark on a fascinating journey into the world of Bitcoin mining.